Contemplations on bullish pre-income Micron discourse’s, areas of strength for roku 51.2m rokublog client measurements and SensorTower’s 2020 application store spending figures, in addition to other things.

Micron Hits Highest Levels Since 2000 on Citi Upgrade, Other Bullish Notes Ahead of Thursday’s Earnings The sell-side gets its affairs in order as sure industry information continues to show up. Do request drivers and less serious down-cycles warrant a few different extension?

Sources: The Fly, TheStreet

Alongside a (late) two-score move up to Buy from Citi, Micron saw cost target climbs on Tuesday from as of now bullish investigators at Deutsche and RBC. The editorial more or less: Business is moving in the correct course for DRAM producers. Costs are at long last ticking higher, client request areas of strength for is (with DRAM producers holding their capex under control) the stock/request balance is looking smart for 2021.

In truth, with Micron having climbed its December quarter direction a month prior against a background of weighty chip-purchasing by buyer equipment OEMs, and with reports of further developing DRAM spot and agreement costs simple to find, those previously mentioned tailwinds weren’t precisely obscure. More than anything, this feels like an instance of investigators not having any desire to look deficiently bullish in front of a profit report and call (due on Thursday evening) that they expect will be loaded with perky numbers and discourse.

In any case, maybe slow on the uptake, but still good enough. With Micron now up over half since early November, a great deal of the pain free income might have proactively been made here. In any case, that doesn’t be guaranteed to make the stock costly, given the underlying changes the DRAM business has seen and the development drivers it has before it.

Cycles are as yet an unavoidable truth for DRAM and NAND producers. However, down-cycles aren’t quite so unpleasant as they used to be for a DRAM industry that is currently to a great extent merged around 3 firms, and which benefits from long haul development in cell phone, server, illustrations card/AI gas pedal and car memory utilization. However 2020 for the most part saw declining DRAM costs (adding to 2019 decays) and extremely blended end-market request drifts, Micron’s following year (TTM) EPS just fell as low as $1.99 (it turned negative in pretty much every earlier down-cycle).

Assuming Micron’s next repetitive TTM EPS top is around $10 — $2.81 underneath the pinnacle it hit during the incredibly impressive 2017/2018 up-cycle — connecting a moderate 15x different to the midpoint between that pinnacle and Micron’s 2020 EPS box yields a $90 stock (13% above where it’s presently exchanging). Something worth mulling over.

roku 51.2m rokublog Reports Strong Q4 User Metrics

Client commitment continues to travel higher… thus should ARPU.

Source: Roku (blog)

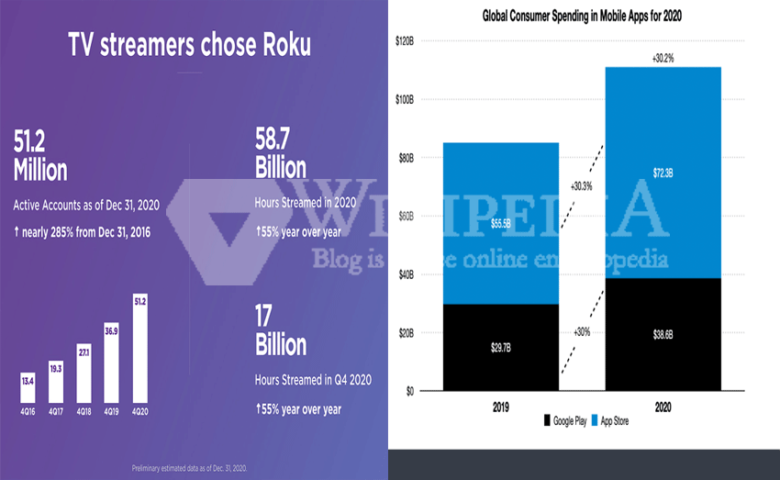

roku 51.2m rokublog dynamic records (they can cover different family individuals utilizing a similar record) rose 11% Q/Q and 39% Y/Y to 51.2M in occasionally solid Q4. Streaming hours rose 15% Q/Q and 55% Y/Y to 17B.

Yearly dynamic record development eased back marginally comparative with Q3, while streaming hours development rose a little. At the end of the day, the two numbers look strong, even subsequent to representing a possible lift from the effect of rising COVID cases on shopper conduct.

With Amazon announcing in mid-December that its Fire TV dynamic records had topped 50M, Roku and Amazon’s TV streaming stages are presently in a dead heat regarding utilization. Nonetheless, roku 51.2m rokublog is growing somewhat quicker: Fire TV dynamic records were above 40M as of Jan. 2020, though Roku was exclusively at 36.9M as of Dec. 2019. Too: Roku’s base slants more towards the U.S. than Amazon’s, which makes it more significant from an adaptation outlook.

Another significant divulgence: The Roku Channel — it highlights both promotion upheld content and Roku’s Prime Video Channels/Apple TV Channels rival — came to an expected 61.8M U.S. families in Q4, up from 54M in Q3 and up 2x Y/Y. That is a ton of families to possibly elevate Quibi’s substance to.

With streaming hours again becoming quicker than dynamic records, Roku’s streaming hours per dynamic record rose to 332 in Q4 from 295 a year sooner. That thus approaches around 3.6 long stretches of review each day per dynamic record. With that number actually well underneath the 7 or more long periods of day to day direct TV seeing U.S. families normal, it actually has space to develop.

One detail that Roku doesn’t break out yet would be good to be aware: what number of its streaming hours include promotion upheld content for which Roku somewhat or completely sells the promotion stock. While Roku sells some or all of the advertisement stock for most promotion upheld channels on its foundation, it doesn’t sell any of YouTube’s stock, and it possibly benefits from membership based channels when recruits occur on its foundation or a channel proprietor utilizes Roku’s “special and crowd improvement instruments” to develop its scope and commitment.

However, one way or the other, 55% all out streaming hours development looks good for roku 51.2m rokublog Q4 ARPU development (ought to be unveiled in its Q4 investor letter) when OTT video promotion spend seems, by all accounts, to be arching and mark advertisement spend overall is bouncing back. Roku’s TTM ARPU was up 20% Y/Y in Q3 to a still-genuinely low $27.00, and there’s a decent opportunity that Q4’s development rate will be higher.

roku 51.2m 14m rokublog

Sensor Tower: Consumer App Store/Google Play Spend Rises 30% in 2020 to $111B

Non-gaming applications become quicker than games, and the App Store keeps up with its income share edge over Google Play.

SensorTower thinks App Store/Google Play spending development advanced to 30% in 2020 from 19% in 2019, with the application stores posting generally comparative development rates. Coronavirus’ effect on computerized media utilization obviously poses a potential threat here.

Strikingly, versatile game spending development (26%) was a little underneath all out spending development. However, it actually sped up pointedly from 2019’s 12.8%, and gaming spend represented 72% of all out spend. roku 51.2m 14m rokublog.

Google had areas of strength for an on SensorTower’s non-gaming application income competitor lists, which cover paid downloads and in-application exchanges however not promotion deals. Google One (previously Google Drive) was the top-netting non-gaming application on Google Play, while YouTube (floated by YouTube Music/Premium memberships as well as Super Chats/Super Stickers) was #2 on the App Store. Likewise, Match Group’s Tinder was #3 on both the App Store and Google Play. TikTok was #1 on the App Store, however that remembers Douyin income for China. roku 51.2m 14m rokublog

Google One’s positioning gives a setting to Google’s questionable (and maybe still off track) choice to quit giving limitless Google Photos stockpiling in June. With the least expensive Google One arrangement costing just $2/month or $20/year, Google is by all accounts betting it’ll get a great deal of recruits among Google Photos clients (however one way or the other, Amazon, which actually gives limitless photograph stockpiling to Prime subs, must be satisfied). roku 51.2m 14m rokublog

The other thing that jumps over here is the means by which the App Store’s assessed income ($72.3B) stayed 87% higher than Google Play’s ($38.6B), despite the fact that Google Play’s assessed first-time application downloads were more than 3x higher (108.5B versus 34.4B) and its application download development rate was over two times as high (27.9% versus 12.1%).

Indeed, even subsequent to representing the way that the App Store works in China and Google Play doesn’t, that income hole says a lot about the segment distinctions among iOS and Android. It likewise gives a setting to why Apple’s questions with designers — everybody from Spotify and Tinder, to Epic Games and cloud gaming specialist organizations, to a large group of more modest engineers — over its App Store installment strategies are such a controversial problem.

Miscellaneous items

RealMoney section: Why the Current Bitcoin Frenzy Possibly Hasn’t Peaked Yet — I composed this not long before the Georgia Senate overflow results came in and (by stirring up expects extra boost) assisted Bitcoin with mobilizing another ~15%. The primary contentions: Bitcoin-related Google search action actually hasn’t raised a ruckus around town seen during the late-2017/mid 2018 crypto craziness (however it has started to spike of late), faith in Bitcoin as a drawn out store of significant worth (whether among retail or institutional financial backers) looks genuinely higher than it completed quite a while back, and a “kid who deceived everyone” mentality could be grabbing hold among the people who have seen Bitcoin completely recuperate from numerous 75%+ accidents. All things considered, we could now be nearer to the furthest limit of this run-up than its start.

Microsoft is closing down portable AR game Minecraft Earth — Microsoft ascribes its choice to COVID’s effect on open air action. Be that as it may, Pokemon Go kept on doing great in 2020, and Minecraft Earth will not be covered until June 30, so, all in all outside action may be seeing a sharp rise. Notwithstanding, the choice is an update that over 4 years after Pokemon Go sent off, we still seemingly haven’t seen a subsequent raving success AR cell phone application or game show up (I suppose you could say Snapchat kind of possesses all the necessary qualities nowadays).

On headsets, AR can become the dominant focal point in light of the fact that a gadget can filter a climate to show significant data/content at whatever point it’s ragged, and in light of the fact that the gadget’s presentation can cover a very remarkable client’s field-of-view. In any case, on a gadget that expects clients to send off an application to have it begin checking the climate, and whose screen takes up just a little part of a client’s field-of-view, AR capacities are (like, say, a NFC radio or a spotlight) only one helpful component out of a large number.

Verizon executive fences a piece on 5G home broadband objective — In late 2017, Verizon said it will arrive at 30M homes (still under a fourth of all U.S. homes) with mmWave 5G fixed broadband inside “the following couple of years.” In mid 2020, Verizon said it would arrive in 5-to-7 years.

Presently, as EVP Ronan Dunne successfully says Verizon’s fixed-remote broadband endeavors will be fringe to its portable buildout and Verizon’s 5G home broadband organization frequently covering simply a small part of the addresses in a local that is proclaimed to be covered, obviously they�